|

|

Planters

Products

Members

Market Data

News

Ag Commentary

Weather

Resources

|

Is HRW Wheat a Buy?

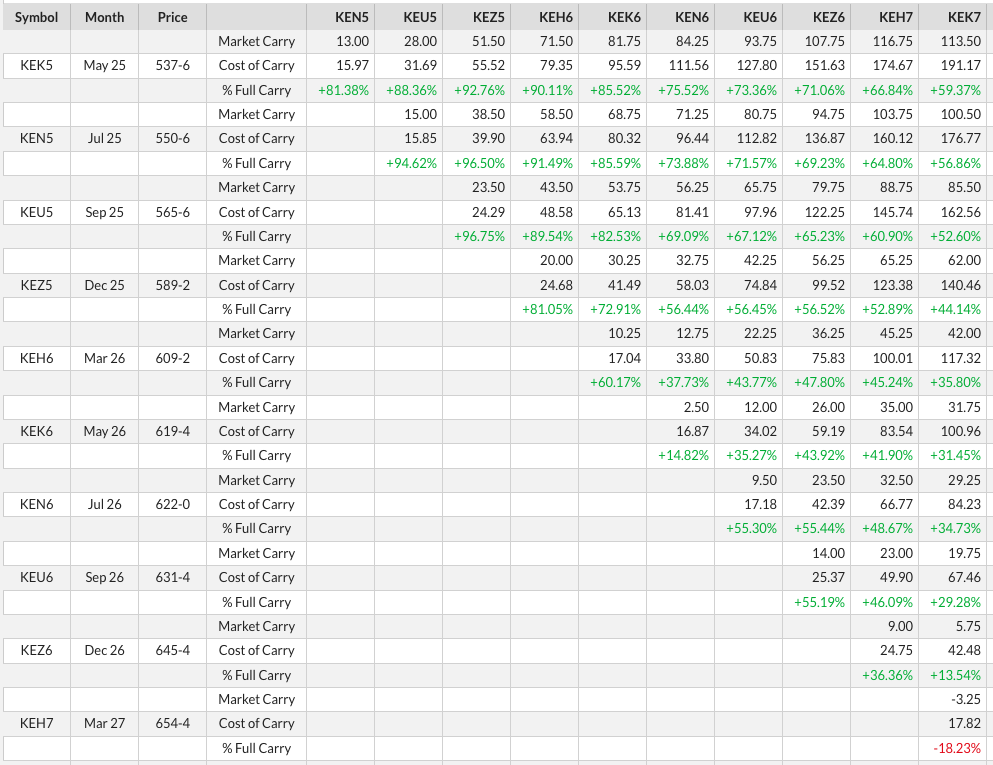

From a technical point of view the July HRW Wheat futures contract (KEN25) completed a bullish spike reversal on its short-term daily chart Thursday. This reversal pattern also coincided with another bullish crossover by daily stochastics below the oversold level of 20%. What does this tell us? The contract both signaled (stochastics) and confirmed (reversal pattern) a new minor (short-term) uptrend at yesterday’s close. But can we believe it? That’s the million-dollar question. Every market in the commodity complex has two sides, noncommercial and commercial. Noncommercial traders consist of trading funds, classic speculators, and large investments groups where traders are largely driven by algorithms, a group I like to call Watson. On the commercial side we have those interests actively involved in the underlying cash commodity. This includes local merchandisers, terminals, end users, exporters, and others I’ve likely forgotten. These two sides make up what I call a market’s structure, creating one of nine market types ranging from the most bullish 9 (both sides are bullish) to most bearish 1 (both sides are bearish). As you would expect given there are 9 market types, the two sides don’t always agree. When this happens, we see markets initially trend in the direction of noncommercial activity, the background for my Market Rule #1: Don’t get crossways with the trend. If you do, you’re fighting against the big money in a market. Historically, the noncommercial has relied on some form of technical analysis, a point I discussed with Barchart Senior Market Strategist John Rowland this past February. The question I usually get asked at this point is, “If Watson sets the trend, are you saying fundamentals don’t matter?” No, I’m not saying that. I’ve never said that. Eventually, markets return to their underlying fundamentals – their real supply and demand, as opposed to the imaginary numbers released by a variety of government agencies. We can read a market’s real fundamentals by looking at its cash price (intrinsic value), basis (differential between the cash price and futures price), spot futures price (where a cash index is unavailable), futures spreads (price difference between futures contracts), and forward curves (futures contracts shown on a price curve).  Getting back to the subject at hand of the short-term bullish reversal completed by July HRW wheat: If we apply my Market Rule #5 (Fundamentals win in the end), then the answer is no given the July-September futures spread closed yesterday covering 95% calculated full commercial carry. If we change calculated full commercial by using the higher storage rate of $0.00265/bushel/day that will take effect on May 19, the spread still covers 67%.  How could Thursday’s pattern be played from a strictly technical point of view? Short-term traders could look at buying near Thursday’s close of $5.5075 with a stop below yesterday’s new contract low of $5.43, making the risk about 8.0 cents. Here’s where Game Theory could come into play, though. If Watson has been programmed with the old wheat market quirk of pulling head fakes, the contract could dip down to a new low before rallying again. Just as it did Thursday. The other possibility is the patterns sparks a round of noncommercial short-covering given this group reportedly held a net-short futures position of 39,290 contracts as of Tuesday, April 15. As a long-term investment trade, I would be inclined to stay on the sidelines in HRW wheat. Real market fundamentals are too overwhelmingly bearish. But others may see it differently. That’s what makes markets. On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|